Managing Employee Claim Risks

Managing people in the workplace can be risky business. Even in the best employment environments, there are opportunities for an employee tobecome disgruntled. Seemingly insignificant mistakes made by a manager can lead to a charge or lawsuit resulting in financial losses for your company.

You can mitigate the risk to your business by purchasing employment practices liability insurance (EPLI).

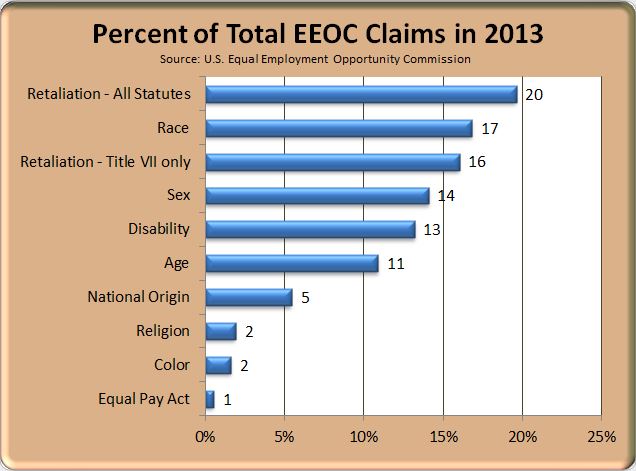

According to the U.S. Equal Employment Opportunity Commission (EEOC) website, claims filed with the EEOC (the government agency that enforces federal employment discrimination laws) increased by 18 percent in just the past 10 years. The basis for the claims span a variety of issues, including discrimination based on race, gender, age and disability.

Your actions and motivation are subject to scrutiny throughout the entire employment process, from recruiting to termination and beyond. Decisions made in the past may be re-examined as state and federal laws change, and challenges to your decisions can be made months and sometimes years later.

Even if you have done everything right, the cost of defending against an employee claim can be prohibitive. While the damages recoverable vary, employers can be required to pay damages for back pay, front pay, other economic losses and mental anguish.

It is always advisable to consult with an attorney when developing employment applications, employee handbooks and other materials, and when making employment decisions. But even that does not prevent an employee who feels he or she was wronged from filing a grievance.

Fortunately, that’s where EPLI coverage fits in. This coverage provides a limit of insurance, separate from the standard commercial policy, which covers your business operations against many actual or alleged wrongful acts that may have been committed. The types and amounts of EPLI coverage that can apply ̶ including co-pay percentages, limits and deductibles ̶ can vary widely.

That’s why it’s important to assess your situation, consult with your attorney and speak to an independent agent who can tailor coverage to fit your needs. In many cases, your insurer can also provide welcome information about employer best practices and sample employee policies or other loss prevention assistance.

Article By Dan Hilbert -Cincinnati Insurance Companies